Latest News and Articles

-

Gold Market Report – May 08, 2024

Overnight: Gold was a bit choppy last night and either side of unch ($2314), trading between $2304 – $2321. It was pressured on the downside by an improving US dollar, as the DX advanced from 105.41 – 105.64. The greenback was helped by: However, gold was supported by a rate cut by the Sweeden’s Riksbank…

-

Could Home Prices Crash As Much As In 2008?

Housing analyst Nick Gerli returns to the program to warn how swiftly the prospects for home prices are eroding. Confidence in the housing market was supreme just a month or two ago. But suddenly that confidence is vaporizing as an increasing number of experts now caution of a “full blown” correction ahead. Rising mortgage rates are a huge part of the…

-

Why Everything That Can Go Wrong From Here Likely Will | Pomboy & Atwater

People are tired of the malaise the markets have been mired in this year. They want to stop worrying & start making gains again. But “no bear market ever ended due to fatigue” socionomics expert Peter Atwater cautions in our new interview with him hosted by Stephanie Pomboy. They end in fear. When no one wants to buy…

-

Social Credit Score? How About a Hard Money Credit Score!

You’ve likely heard about the idea of a social credit score, where citizens could be graded on how environmentally or socially responsible they are. You recycle? Score one. You don’t recycle, minus one. You drive an electric vehicle? Score ten. You drive a carbon-spewing SUV, minus ten. We can debate how effective something like this…

-

Gold in 2021: A Fed Pivot and Stubborn Inflation Give Hints About 2022

Our quarterly report—what we prepare for institutional investors—examines the performance of gold and silver vs. other major asset classes during the fourth quarter and full year of 2021. We also review the conditions that could ignite their prices in 2022. The big story in 2021 was the jump in inflation. And then the Fed’s announcement…

-

UPDATE: What If the Silver Price Matched Other Asset Gains from 1980?

It’s no surprise to our constituency, but silver remains one of the most undervalued investments that can be bought today. Regardless of almost any asset class you compare it to, silver offers a better value to investors right now than almost anything else. A big reason is because it’s one of the few assets still…

-

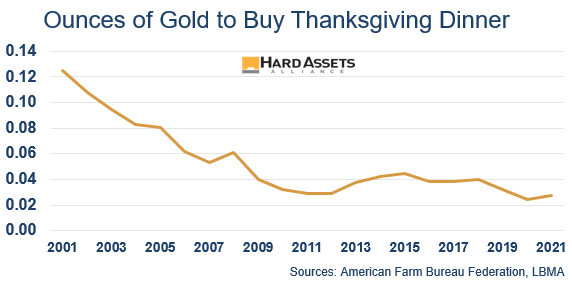

Thanksgiving Dinner Has Gotten More Expensive – Unless It’s Priced in Silver and Gold

The American Farm Bureau Federation says the cost for all the ingredients of the traditional Thanksgiving dinner rose 5% this year, now $49.24. No surprise it’s higher in 2021. But our question here at Hard Assets Alliance is… do gold and silver offset this rise? That’s a fair query, since gold is down 2% on…