Latest News and Articles

-

Gold Market Report – April 25, 2024

Overnight Activity: Gold remained nervous and volatile last night, but moved higher while trading in a range of $2305 – $2331. The yellow metal moved down to its $2305 low during Asian time, against an uptick in the US dollar (DX from 105.77 – 105.84). The DX was buoyed by: Gold rebounded during European hours,…

-

Is Our Money Dying?

As governments increase their debts & unfunded liabilities, servicing them becomes a bigger and bigger problem. That’s especially true if the pile of debt is growing much faster than the underlying economy, which has been the case for decades. This forces central banks to print more new currency in order to enable their governments to handle the debt…

-

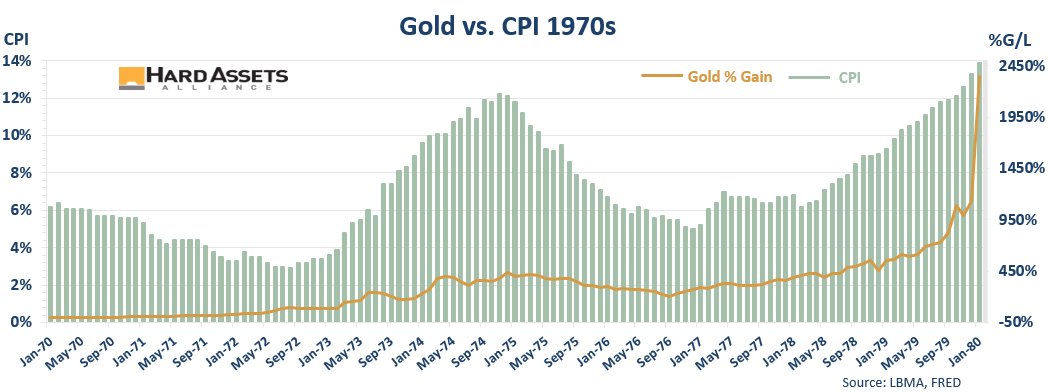

Silver & Gold’s Historical Correlations to High Inflation: This Answers Some Questions

Probably the biggest knock against gold and silver right now is that they’re not rising in response to spiking inflation. This is what many investors know them for, after all. Yet despite the CPI—the Consumer Price Index that tracks price changes in everyday goods and services—reaching 40-year highs, gold and silver prices have been weak.…

-

Robert Kiyosaki: Worst Crash Of Our Lifetime Ahead, Here’s What The Wealthy Are Doing Says Rich Dad

With inflation driving the costs of living higher, real wages falling behind and financial assets having one of their worst years ever so far, it’s a tough time to build wealth right now. And it’s likely to get even worse, says today’s guest, Robert Kiysosaki, author of Rich Dad, Poor Dad, the #1 best selling…

-

Could Home Prices Crash As Much As In 2008?

Housing analyst Nick Gerli returns to the program to warn how swiftly the prospects for home prices are eroding. Confidence in the housing market was supreme just a month or two ago. But suddenly that confidence is vaporizing as an increasing number of experts now caution of a “full blown” correction ahead. Rising mortgage rates are a huge part of the…

-

Why Everything That Can Go Wrong From Here Likely Will | Pomboy & Atwater

People are tired of the malaise the markets have been mired in this year. They want to stop worrying & start making gains again. But “no bear market ever ended due to fatigue” socionomics expert Peter Atwater cautions in our new interview with him hosted by Stephanie Pomboy. They end in fear. When no one wants to buy…

![Worried About a Recession or Stock Market Crash? Here’s How Gold – and All Precious Metals – Have Historically Performed [CHARTS]](https://hardassetsalliance.com/wp-content/uploads/2022/07/image001-2.png)