The Best Way to Invest in Gold and Silver

- True Ownership: Global Vaults, On-Demand Delivery

- Digital Access: Invest Online 24/7

- Trusted Platform: Over $3B in assets; more than 100,000 investors.

Open an account today.

We imagined a better gold-buying experience.

Then we built it.

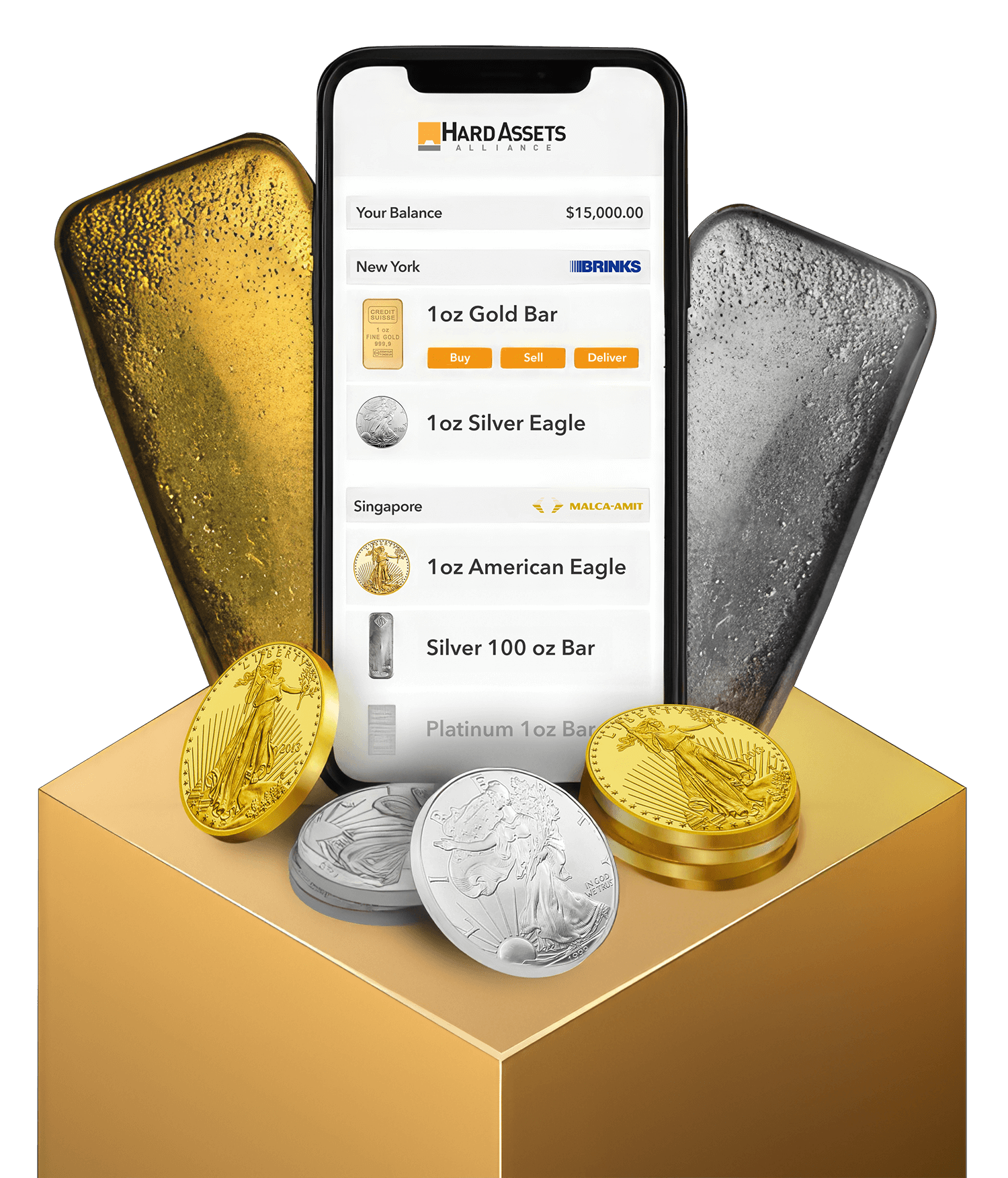

Easy, Incredibly Powerful

Online Marketplace

Fund, buy, sell, and manage your holdings on a refreshingly simple platform—the same platform trusted by many of the world’s largest wealth managers. Behind the scenes a network of wholesalers bid on every order. This makes us the agent, ensuring you get the best price possible.

Security, Without Sacrifice

Access the world’s most popular whole bars and coins, not paper promises or small shares of giant bars you can never claim. Once they’re yours, we store them in the world’s most secure non-bank vaults, including Brinks, Loomis, and Malca-Amit.

Always Available,

Always Liquid

It’s your gold, truly allocated in your name. Take delivery from the start, or any time later, around the world. Add to or sell some of your holdings any time. All online in a matter of seconds.

Powerful Financial Solutions

Diversify your financial plan with the best performing major asset class of this century. Get tax-advantaged returns with gold in an IRA. Help secure the next generation with full support for trusts and UTMAs. Or own gold as a company asset.

Why Us? We’re Glad You Asked.

Built Strong

A platform built on the same standards that the world’s largest wealth managers demand.

Trusted & Proven

Secure as buying stocks and bonds, truly allocated with on-demand delivery.

Honest & Smart

$2 billion under management

backed by professionals who value honesty and transparency.

We’ll protect your wealth and make it last for the next generation.

Testimonials

What Smart Investors Are Saying…

“Right now, considering what’s happening across the US economy and working its way around the world, you simply must own gold and silver. Find out more about HAA… With that, I rest my case.”

“The ability to use small amounts of cash on a monthly basis to buy physical gold and silver at good prices—and have them stored both in Singapore and New York—is a great capability for someone trying to build up a holding on an incremental basis.“

“I have had reason to call your customer support a few times and I have always been courteous and quick responses to my inquiries. Thank you for doing a great job.”

“I have used HAA only twice, but both times is was easy to transfer money and purchase gold and silver for delivery. The prices were quickly established and compared reasonably well with other sites.”

“I love the ability to store and trade on HAA and I feel they are safe. The liquid nature of your platform is vital to me as I am more and more concerned about having my cash sit in banks.”

FREE REPORT

Why Portfolios Perform

Better With Gold

Greater overall returns, less volatility. See the true power of gold in this free report that compares the performance of portfolios with gold allocations to those without.

Download Free!

Let us know who you are and where to send your free guide!